What could happen for your Amazon business when you have the capital to invest in the right sales-boosting tactics?

Do you feel like you are stuck in a rut with your Amazon business? It doesn’t take long before the excitement of owning your own business can fade when things aren’t going as you had expected. It gradually happens as you fully realize there’s never enough time or money to put important sales-boosting tactics into action. The result? Your business stagnates.

You see other sellers growing by leaps and bounds. But what’s the real difference between an Amazon seller that is thriving and one that is barely getting by? Business multipliers and marketplace financing.

From advertising tools like Amazon PPC and effective SEO to strategies such as brand reach expansion and brand promotion, you know there are plenty of tactics you should be using, but there just aren’t enough hours in the day or dollars in the budget. It’s only when you have the funds in place to support your business that you can begin to invest in the tools that will result in serious growth.

Here are five ways marketplace financing frees Amazon sellers to move the needle:

#1: Level the Playing Field

Positioning your Amazon store for success costs money. Marketplace financing enables you to have the wiggle room in your budget to get your business on the fast track to growth. Imagine how your business would progress if you had the funds to cover your inventory. Then, you would have the budget available to take full advantage of the same tools the top Amazon sellers have used to make it where they are today.

The right Amazon credit line essentially levels the playing field between the big dogs and the trying-to-get-big dogs. It’s only right that you should have the power of the best marketing and advertising tools on your side in order to have the same advantages that other sellers in the marketplace have.

#2: Invest in Tools Designed to Boost Your Business

What sales-boosting tools would you use for your business if money wasn’t an issue? Many Amazon sellers miss out on profitable opportunities because they can’t afford to invest in money-making multipliers like:

- Advertising and marketing tactics

- Customer service and review requests

- Product listings

- Inventory management

- Demand planning

Not having the time or the money to incorporate these tactics is setting up your business to be at a disadvantage. An optimal e-commerce lending opportunity can change all of that; you will be able to put your time and money in the right places.

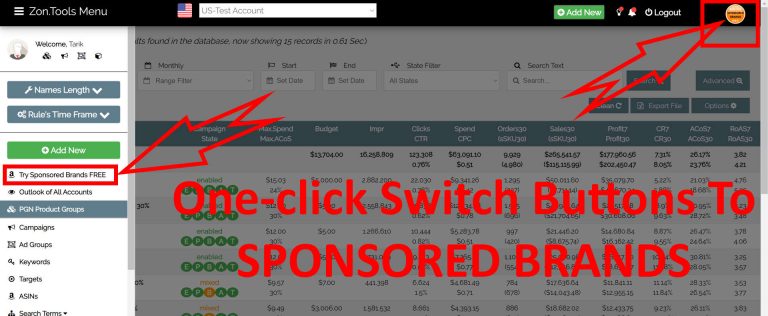

#3: Automate Amazon PPC

A well-structured Pay Per Click (PPC) campaign is one of the most effective ways to increase exposure and reach new customers in the marketplace. While it may have been out of the question for your budget in the past, after you secure an Amazon seller loan, it’s a different story. You will finally be able to invest in a service that provides a custom-designed, fully-automated PPC campaign. This is the kind of advertising tactic that will pave the way for you to gain a competitive edge without adding more tasks to your already full plate. You will soon discover that automation is a beautiful thing and very good for business!

#4: Improve Amazon Product Ranking

In order to jump ahead of your toughest competitors, your Amazon product ranking needs to be on page one. Is it possible to get up there with the highest-performing FBA sellers? Absolutely. However, it may cost you an investment upfront. With the right financing solution, you can take advantage of professional software that will get your product listing the exposure it needs. Bonus: it’s automated too, so you will be able to save time while making your business more profitable.

#5: Get Customized Funding that Works for Your Unique Needs

It’s clear that marketplace financing can be a game-changer for your business. Perhaps one of the biggest benefits is the fact that the right lender can make the entire financing process hassle-free for you with no off-putting terms or fees. This is not your typical bank loan with all of the hoops to jump through.

Your best lending option will offer these features:

- Loan services that are tailored to your unique business structure and metrics

- Lending flexibility and long-term coverage

- Specialization in e-commerce lending—specifically for Amazon sellers

By turning to a Marketplace financing provider that understands the Amazon seller’s situation, you will experience the benefits of lending without the drawbacks of bank loans. No more feeling like you are always at a disadvantage because you can’t afford to invest in the same professional tools and services the top sellers use. Now is the time to jump on the opportunities in front of you, so you can move that needle for your Amazon business.

Also published on Medium.